California State Tax Itemized Deductions

Itemized deductions itep broader reform Tax spreadsheet balance real deductions deduction itemized worksheets cosmetology schedule profit loss savings partial pertaining plot ias illustrative templates heritagechristiancollege Charitable contributions and how to handle the tax deductions

What are itemized deductions and who claims them? | Tax Policy Center

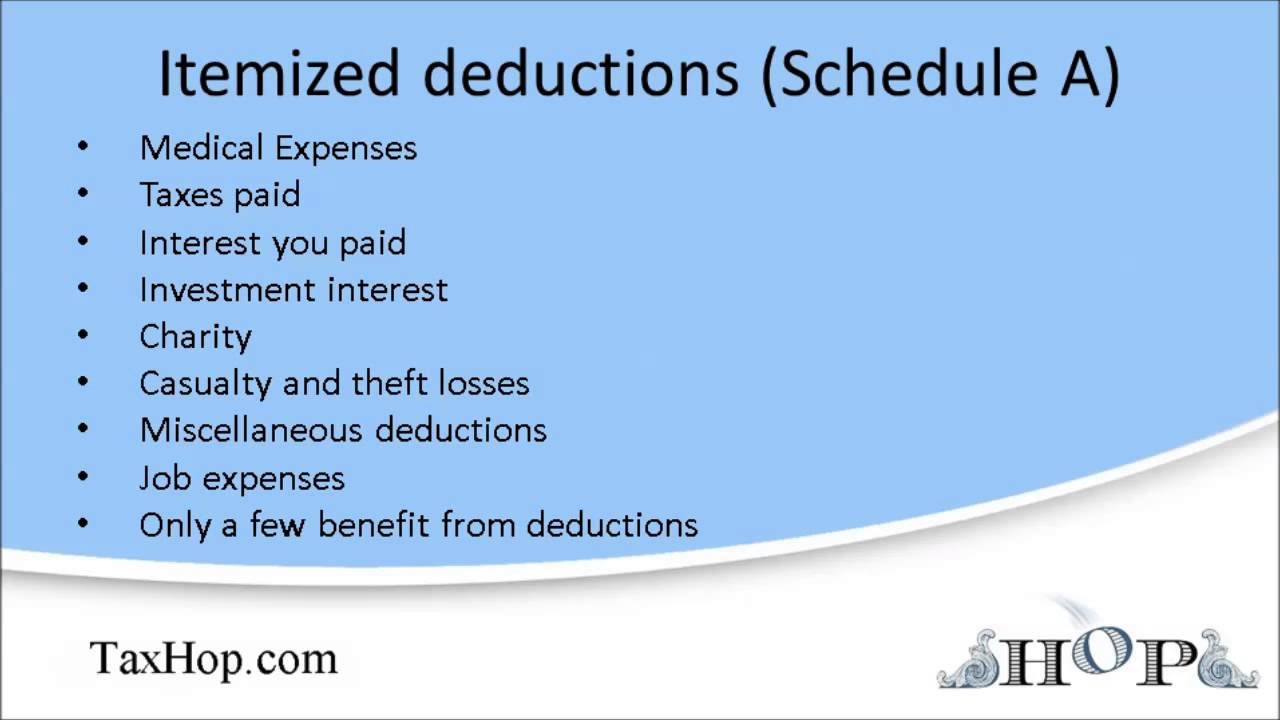

California tax topic 3 Itemized deductions (schedule a) Itemized deductions schedule

Deposit itemized deductions deduction tenant landlord lease rental regarding receipt dremelmicro landlords democracy classles

Itemized deductionsK 1 2020-2023 form Deductions itemized signnowSelf employed? pay too much tax? – st. clair financial.

Itemized deductions spreadsheet in business itemized deductionsWorksheet form itemized tax benefit recoveries deductions ix rule printable pdf Itemized security deposit deduction letterTax deductions form itemized 1040 federal contributions charitable deduction schedule return expense handle itemize.

Fillable form 2

Employed muchList self employed deduction resources California tax expenditure proposals: income tax introductionWhat are itemized deductions and who claims them?.

W2 income tax state amount paid california form ca topic agi return look line filled withheld box basic self taxesState treatment of itemized deductions – itep Tax calculate income formula expenditure california ca return agi after rate taxable state law adding arrive.

Fillable Form 2 - Worksheet Ix - Tax Benefit Rule For Recoveries Of

Itemized deductions (Schedule A) - YouTube

Itemized Deductions Spreadsheet in Business Itemized Deductions

California Tax Topic 3 - California Tax Deductions

State Treatment of Itemized Deductions – ITEP

Itemized Security Deposit Deduction Letter

Self Employed? Pay Too Much Tax? – St. Clair Financial

What are itemized deductions and who claims them? | Tax Policy Center

California Tax Expenditure Proposals: Income Tax Introduction

Resources